Content

To record credit sales, create an accounts receivable ledger where you record each customer’s outstanding payments and their respective due dates. For debit sales, directly deposit the funds into your bank account or cash register. Your credit sales journal entry should debit your Accounts Receivable account, which is the amount the customer has charged to their credit. Sales are a part of everyday business, they can either be made in cash or credit. In a dynamic environment, credit sales are promoted to keep up with the cutting edge competition. Accounting and journal entry for credit sales include 2 accounts, debtor and sales.

It does more than record the total money a business receives from the transaction. Sales journal entries should also reflect changes to accounts such as Cost of Goods Sold, Inventory, and Sales Tax Payable accounts. How you record the transaction depends on whether your customer pays with cash or uses credit.

Credit Sales and Credit Terms

Read on to learn how to make a cash sales journal entry and credit sales journal entry. When companies offer goods or services to their customers on credit, it is termed credit sales. Credit sales refer to sales that are not paid for immediately upon purchase. The customer who owes the company for the good or service is called a debtor while the amount owed is considered a current asset called an account receivable. When a company sells goods on credit, it reports the transaction on both its income statement and its balance sheet. On the income statement, increases are reported in sales revenues, cost of goods sold, and (possibly) expenses.

How do you record credit in a journal entry?

Debits are recorded on the left side of an accounting journal entry. A credit increases the balance of a liability, equity, gain or revenue account and decreases the balance of an asset, loss or expense account. Credits are recorded on the right side of a journal entry.

The account receivable records all monies owed to the company by customers who received either goods or services on credit. There are basically two journal entries made to record credit sales; first when the good or service is purchased and then later on when the good or service is paid for. Both of these journal entries are useful when preparing financial statements, forecasting the business’s revenue as well as budgeting for the future.

Relax—pay employees in just 3 steps with Patriot Payroll!

In case of a journal entry for cash sales, a cash account and sales account are used. The buyer in any sales transaction is not required to make an upfront payment to the seller. Instead, the seller offers a certain credit period to the buyer for making the payment. In accounting, a credit sales transaction creates a receivable in the books of accounts of the seller.

- Liabilities, equity, and revenue are increased by credits and decreased by debits.

- Since the ledger accounts are closed to the General Ledger, this account balance indicates that there are no more invoices in which credits have not been posted.

- The format of the sales returns and allowances journal is shown below.

- Debit sales eliminate this risk as payment is received upfront, which provides immediate cash flow for businesses.

- Sales revenue is the income generated from selling goods or services to customers.

Recording sales revenue is crucial for every business to keep track of its financial performance. To record sales revenue, you need to understand the different types of transactions that contribute to it. Some people believe that the credit term of 2/10, net 30 is far too generous. Some sellers won’t offer terms such as 2/10, net 30 because of these high percentage equivalents.

How to record sales revenue in your business

Creating a credit sales journal entry usually involves a debit to the account receivable and a debit to the sales account. Accurately recording accounts receivable and any sales returns is vital to good record keeping. According to Accounting Capital, at the time of the credit sales, a business’ credit purchase journal entry records accounts receivable as a debit and sales as a credit in the amount of the sales revenue. Instead of receiving cash from the sales, companies agree to delayed payments by holding customers’ accounts receivable. Because no cash changes hands, for any returned sales from customers, businesses debit sales returns to reduce earlier sales, and credit accounts receivable to arrive at the reduced outstanding balance. The credit sales journal entry is an entry in a company’s sales journal which is used to record the sale of goods or services on credit.

In simple words, goods are transferred, or the seller renders services to the buyer, but the payment is promised to be done at a later date. The customer has an account with your store and plans to buy this merchandise on credit. Here is the bookkeeping entry you would make, hopefully using your computer accounting software, https://www.bookstime.com/ to record the journal transaction. Double-entry bookkeeping is called “double-entry” because each transaction is recorded in at least two accounts using debits and credits. If you make a debit in one account, you must make a credit in another account. The total debits and credits must balance, or be equal to each other.

Timely Payments

If a customer does not pay within the discount period of 10 days, the net purchase amount (without the discount) is due 30 days after the invoice date. Credit sales are reported on both the income statement and the company’s balance sheet. On the income statement, the sale is recorded as an increase in sales revenue, cost of goods sold, and possibly expenses. The credit sale is reported on the balance sheet as an increase in accounts receivable, with a decrease in inventory. A change is reported to stockholder’s equity for the amount of the net income earned.

This means the seller is responsible for transporting the goods to the customer’s dock, and will factor in the cost of shipping when it sets its price for the goods. If the sale is made with the terms FOB Shipping Point, the ownership of the goods is transferred at the seller’s dock. If the sale is made with the terms FOB Destination, the ownership of the goods is transferred at the buyer’s dock. Get up and running with free payroll setup, and enjoy free expert support. In a cash-tight economy, this is an essential aspect of overall cash management. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

What are Credit Sales?

In other words, the $900 amount can be settled for $882 if it is paid within the 10-day discount period. On the books of the seller, the customer’s accounts receivable account has a debit balance. Thus, the term credit memorandum indicates that the seller has decreased the customer’s account and does not expect payment. For example, A Ltd sells an Air Conditioner worth $5,000 to Mr. B and agrees to settle the payment after 30 days. When companies extend credit to a customer, it carries a certain time period in which the invoice or amount of sale is due, e.g., 30 days. The company may also offer a discount if payment is made within a shorter period of time, e.g., 10 days.

- An effective credit control policy needs to maximize sales and minimize bad debts.

- It does more than record the total money a business receives from the transaction.

- There is a decrease/outflow in cash and an increase in the expense (a decrease on both sides of the equation).

- This information can be utilized in creating financial statements such as income statements and balance sheets, which are critical in measuring a company’s profitability.

- Both of these journal entries are useful when preparing financial statements, forecasting the business’s revenue as well as budgeting for the future.

- In deciding whether originally to grant credit or to extend credit limits, the firm must obtain information about customers, such as their financial condition and past credit history.

- The bad debt expense is debited as part of the overall cost of making the credit sales, and the allowance for doubtful accounts is credited as a reduction to the total amount of accounts receivable.

You can use double-entry bookkeeping when selling a product or service on credit. The average collection period is calculated by dividing total annual credit sales by half the sum of the balance of starting receivables and the balance of ending receivables. The average collection period, as well as the receivables turnover ratio, offer useful insight into assessing the company’s cash flow and overall liquidity. Debit sales eliminate this risk as payment is received upfront, which provides immediate cash flow for businesses.

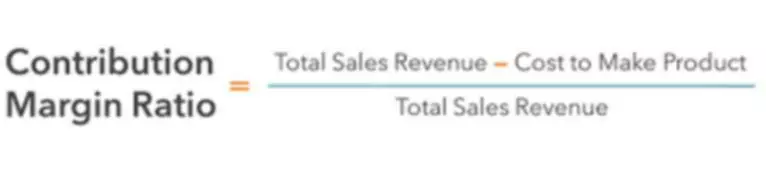

How do you calculate Credit Sales?

One significant benefit of recording sales revenue is that it provides a clear picture of the amount of money coming into the company. This information can be utilized in creating financial statements such as income statements and balance sheets, which are critical in measuring a company’s profitability. Sales revenue can be recorded on either a cash basis or an accrual basis. For many purchases, https://www.bookstime.com/articles/how-to-record-a-credit-sale such as supplies and travel, certain members of the company may have company credit cards. In that case, the purchases may not show up as transactions until the bookkeeper receives the credit card statement, which may be in the next accounting period. If the amounts are immaterial according to the company’s subjective assessment of that term, recording June expenses in July may be acceptable.

- The business would record this transaction at the end of every month until the prepaid asset is reduced to a balance of $0.

- The original memo is sent to the customer and the duplicate copy is retained.

- The business will only use that asset when it prints something on the paper.

- It is usually included if there are any sales returns and allowances or other type of return not recorded in the sales journal.

- Unlike a straight cash sale journal entry example, recording credit sales is not complete until businesses have actually made cash collections.

- If a customer does not pay within the discount period of 10 days, the net purchase amount (without the discount) is due 30 days after the invoice date.

In principle, this transaction should be recorded when the customer takes possession of the goods and assumes ownership. Businesses specify in the terms of credit sales when customers must make their cash payments. The terms may also allow customers to make early cash payments for a discount. To record regular, on-time cash collections, businesses debit the cash account and credit accounts receivable to remove collected customer accounts. To record early cash collections, businesses debit both the cash account and the account of sales discounts as an expense and credit accounts receivable to reduce the outstanding balance.

How to Record Credit Sales?

When businesses understand how to make the credit sales journal entry, it aids them in making informed decisions about offering or withdrawing the option of purchasing goods and services on credit. It also aids in making better operational decisions and improves the management of finances. Here, our discussion shall focus on how to make the credit sale journal entry, examples, and the advantages and disadvantages of credit sales. A credit sale journal entry is an accounting transaction used to record the sale of goods or services on credit. It involves a debit to the accounts receivable and a credit to the sales account. It is an especially common journal entry for companies who sell goods on consignment or offer a long payment duration for goods purchased.